By Lincoln Salmon

•

April 15, 2024

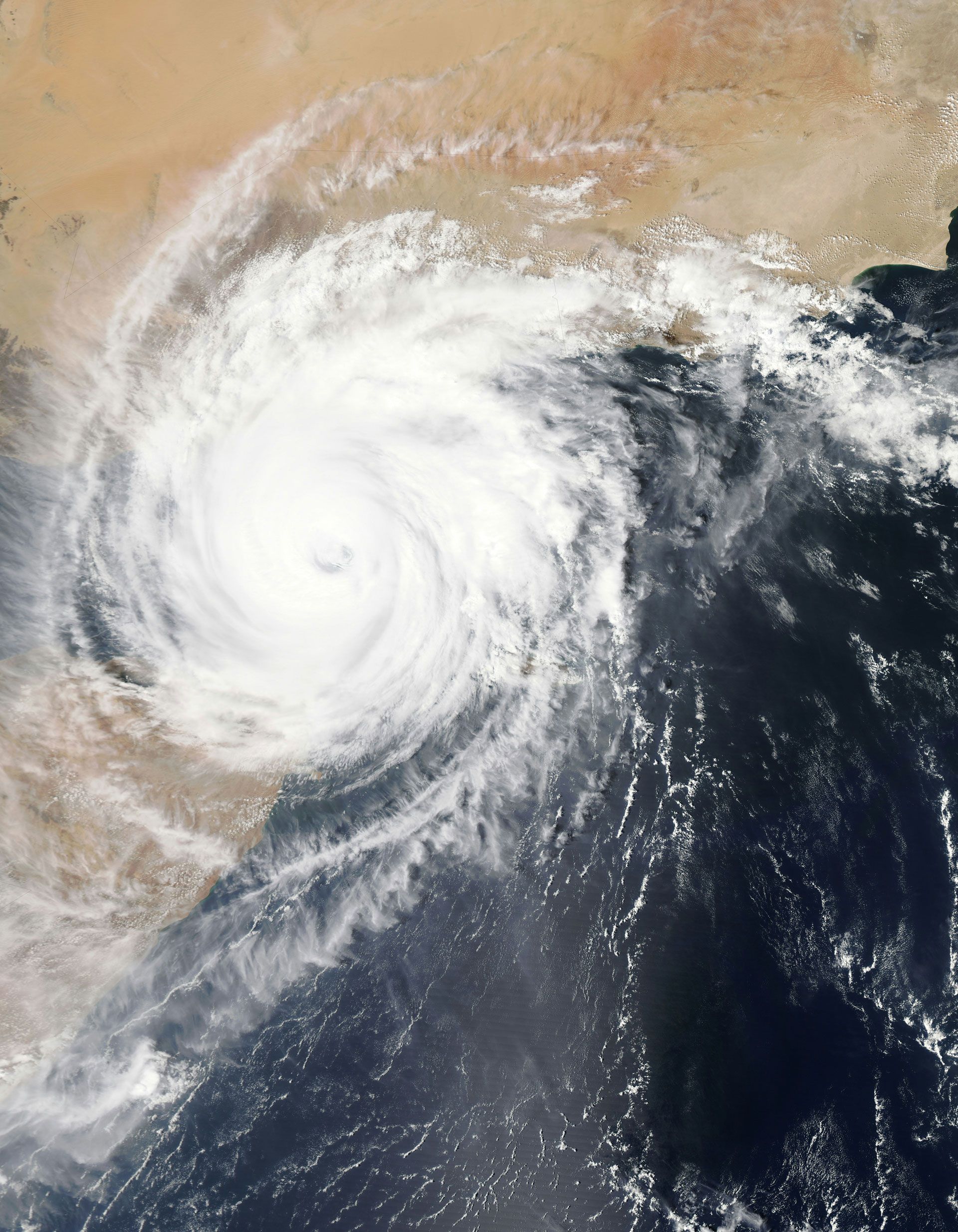

Floridians: Hurricane season is approaching! If you’re a resident of Central Florida, you must take steps to protect your home, your family, and your assets from potential damage. In addition to preparing your home and stocking up on essentials, it’s crucial for you to review your insurance coverage to ensure you’re adequately protected. Let’s dive into the importance of having the right insurance coverage, learn practical tips for hurricane preparedness, and outline the necessary steps to take in the aftermath of a storm. The Importance of Good Insurance Coverage Protecting your Home: Homeowners insurance typically covers damage caused by wind, rain, and other dangers associated with hurricanes. However, it’s essential to review policy limits and exclusions to ensure adequate coverage for potential damages. With Central Florida being a hurricane-prone region, you should consider purchasing insurance that covers not only property damage but also additional living expenses in case you need to evacuate your home. Flood Insurance: Standard homeowners insurance policies often do not cover flood damage. Given that Central Florida is affected by flooding due to hurricanes, purchasing flood insurance through the National Flood Insurance Program (NFIP) or a private market insurer (salmon website) is crucial for comprehensive protection. Flood insurance policies typically have a 30-day waiting period before coverage takes effect, so it’s important to plan ahead and secure coverage well before hurricane season begins. Windstorm Insurance: Some insurance policies may require separate windstorm coverage, especially in areas prone to high winds and hurricanes. Review policy details to confirm coverage for wind-related damages, such as roof damage, broken windows, and structural issues. It’s also important to understand any deductibles associated with windstorm coverage and how they may impact the cost of repairs after a hurricane. Some Tips to Prepare for Hurricane Season Review your Insurance Policies: Before hurricane season begins, review your homeowners, flood, and windstorm insurance policies to understand coverage limits, deductibles, and exclusions. Consider consulting with an insurance agent to ensure you have adequate protection based on your property’s location and unique risks. Flood Insurance: Document your belongings and their value through photos, videos, or written inventory. This will facilitate the claims process in case of damage or loss during a hurricane. Keep important documents, such as insurance policies, in a waterproof and portable container as part of your emergency preparedness kit. Windstorm Insurance: Take proactive measures to secure your property and minimize potential damage from high winds and flying debris. Reinforce windows and doors with storm shutters, trim trees and shrubs, and secure loose outdoor items. Consider investing in impact-resistant roofing materials and garage door braces for added protection against hurricane winds. Develop an Emergency Plan: Create a family emergency plan that includes evacuation routes, designated meeting points, and contact information for emergency services and loved ones. Stock up on essential supplies, including non-perishable food, water, medications, flashlights, batteries, and first aid supplies. Some steps to take after the hurricane Assess Your Damage Safely: After the hurricane passes, wait until it’s safe to venture outside and inspect your property for damage. Exercise caution when assessing damage and avoid touching downed power lines or entering flooded areas. Take photos or videos of the damage to support your insurance claim and document the extent of damage. Contact your Insurance Provider, if necessary: Report any damage to your insurance company as soon as possible. Provide detailed information about the extent of the damage and follow their instructions for filing a claim. Be prepared to provide your policy number, contact information, and a description of the damage when reporting a claim. Keep records of all communication with your insurance provider, including claim numbers and adjuster information. Mitigate Further Damage: Take immediate steps to prevent further damage to your property, such as covering broken windows, tarping roofs, and drying out water-damaged areas. Keep receipts for materials and services used to mitigate damage, as these expenses may be covered by your insurance policy. Work with reputable contractors and restoration professionals to ensure the repairs are completed safely and effectively. Document Expenses: Keep detailed records of expenses related to hurricane recovery, including temporary accommodations, repairs, and replacements. This information will help support your insurance claim and ensure that you receive fair compensation for your losses. Be sure to submit all relevant documentation to your insurance company in a timely manner and keep copies for your records. Conclusion Make sure you prepare in advance for hurricanes in Central Florida so you can mitigate the financial impact of storm damage and protect your home and family. Remember to stay informed, stay safe, and be proactive in safeguarding your property against the unpredictable forces of nature. With proper planning and preparation, you can weather the storm and come out stronger!