Flood Insurance: Essential Home Protection Against Flood Damage

Introduction

In regions like Florida, where the risk of flooding is a constant concern, understanding and securing flood insurance is crucial for homeowners. This specialized insurance provides financial protection against damages caused by flooding, a peril not typically covered under standard homeowners insurance policies.

Understanding Flood Insurance

Definition and Basics

Flood insurance is a specific type of property insurance that covers losses to your home and personal property due to flooding. It's crucial to note that standard homeowners insurance does not cover flood damage.

Coverage Details

A standard flood insurance policy typically includes:

- Structural Damage: Covers the repair or rebuilding costs for your home's structure.

- Personal Property: Provides compensation for damaged personal items.

- Living Expenses: Assists with costs if your home is temporarily uninhabitable.

Assessing Flood Risk

Risk Factors

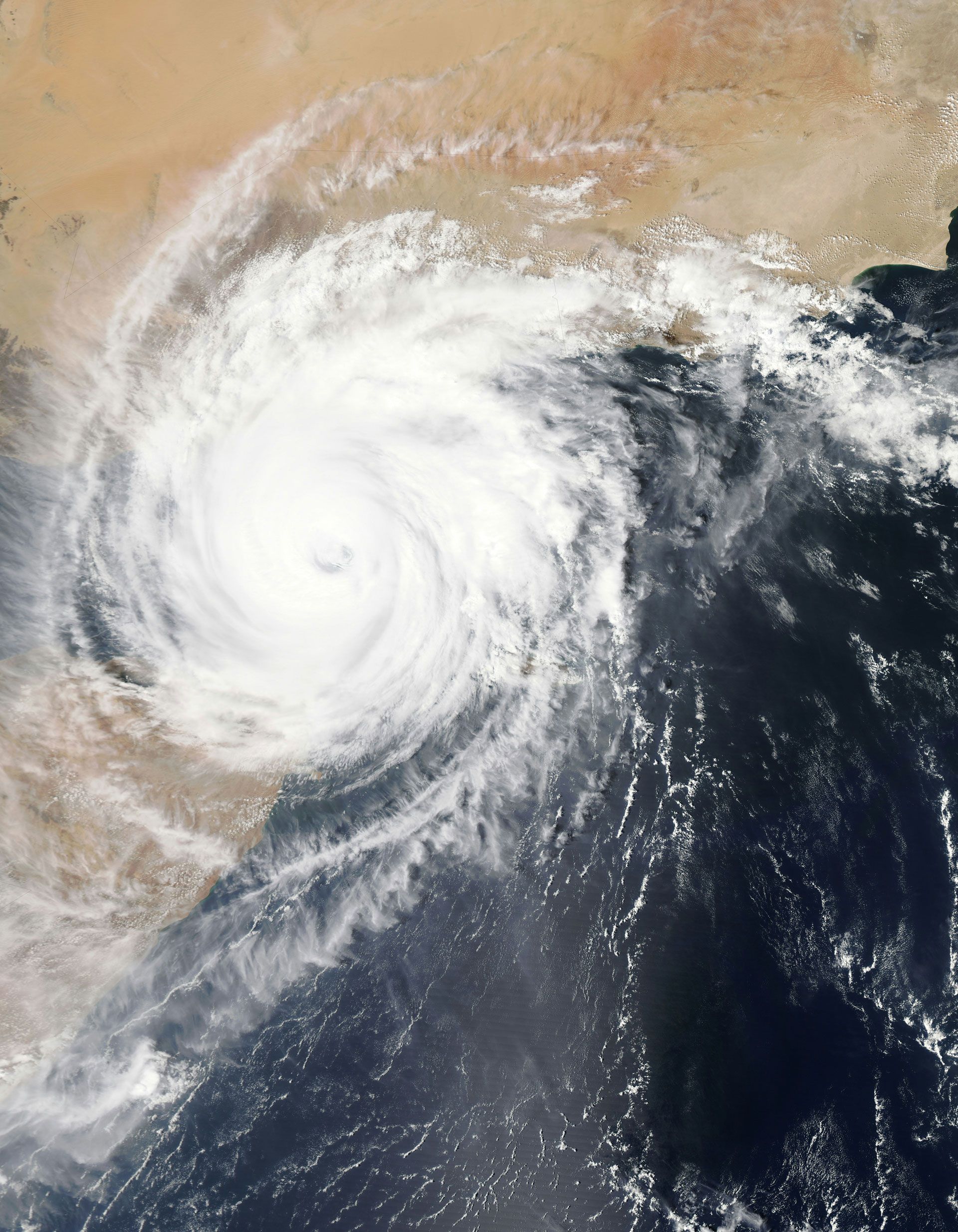

Key factors influencing flood risk include proximity to water bodies, regional climate patterns, and local topography.

Importance of Risk Assessment

Proper risk assessment is essential for determining the need and level of flood insurance coverage. Homeowners should use flood maps and risk assessment tools to gauge their property's vulnerability.

The Necessity of Flood Insurance

Protection Against Flood Damage

Flood insurance acts as a safety net, ensuring homeowners can recover from flood-related losses.

Case Studies

Examples of flood recovery highlight the critical role of flood insurance in post-disaster financial stability. Flood Insurance vs. Homeowners Insurance

Comparative Analysis

Homeowners insurance covers various property damages but typically excludes flood damage, underscoring the need for a separate flood insurance policy.

Misconceptions Clarified

Many homeowners mistakenly believe their standard policy covers flood damage, which can lead to significant financial hardship in the event of a flood.

Choosing the Right Flood Policy

Factors to Consider

When selecting a flood insurance policy, homeowners should consider coverage limits, deductibles, and policy exclusions.

Policy Types

Options range from National Flood Insurance Program (NFIP) policies to those offered by private insurers, each with unique coverage aspects.

Financial Implications

Cost of Flood Insurance

The cost varies based on location, flood risk, and the value of the insured property.

Long-term Financial Benefits

Investing in flood insurance can prevent devastating financial losses during a flood event. Steps to Acquire

Flood Insurance

Process Overview

To obtain flood insurance, homeowners should:

- Assess their flood risk.

- Compare policy options.

- Choose the policy that best fits their needs.

Resources and Assistance

FEMA's Flood Map Service Center and insurance advisors can provide guidance in selecting the appropriate policy.

Preparing for Flood Events

Preventive Measures

Homeowners can minimize flood damage through measures like elevating utilities and installing flood barriers.

Community Resources

Local programs often offer support for flood preparedness and recovery.

Conclusion

Flood insurance is an indispensable safeguard for homeowners, particularly in flood-prone areas. It ensures financial resilience in the face of potential flood disasters.

Next Steps

Evaluate your flood insurance needs and take steps to protect your home and financial future.

Get a personalized quote online today and start protecting your home and future.