Most Common Denied Florida Insurance Claims

I. Introduction

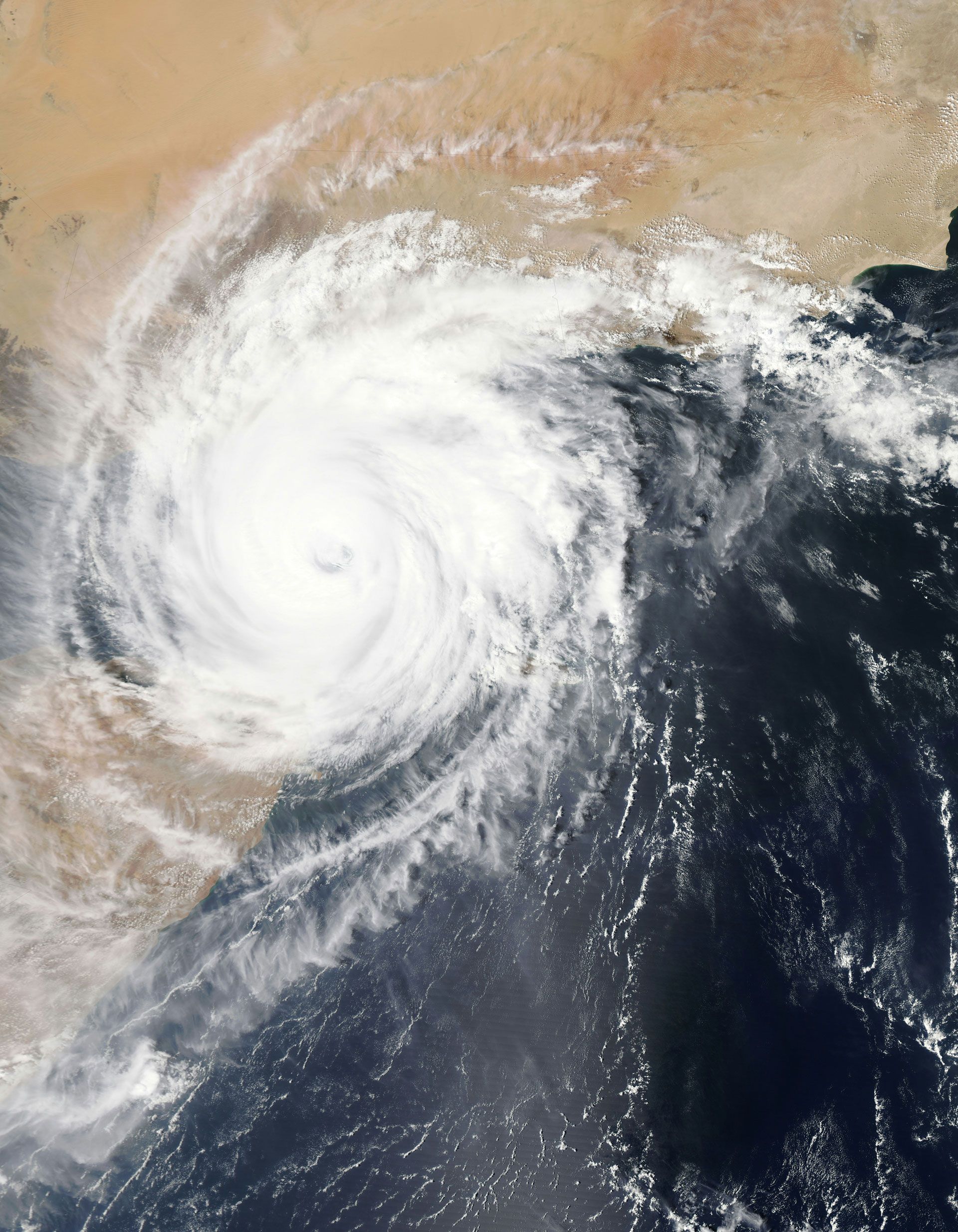

Florida's insurance landscape is as diverse and complex as its weather patterns. From hurricanes to floods, residents face unique challenges that make understanding the nuances of insurance claims crucial. This article sheds light on the most common reasons for insurance claim denials in Florida, emphasizing the importance of being well-informed and prepared.

In Florida, where natural disasters are not just possibilities but realities, navigating the insurance claim process can be daunting. Understanding why claims are denied is the first step in ensuring your property is adequately protected.

II. Flood Damage Claims

Why are flood damage claims often denied in Florida? Despite its susceptibility to floods, standard homeowners policies in Florida typically exclude flood damage. This section will delve into the critical need for separate flood insurance, especially in high-risk flood zones.

- Standard Policies vs. Flood Insurance:

Most standard homeowners policies do not cover flood damage. It's essential to understand the need for a separate flood insurance policy.

- High-Risk Areas: In Florida, many areas are prone to flooding. Knowing whether your property is in one of these areas is crucial for adequate insurance coverage.

III. Hurricane and Windstorm Damage Claims

Hurricanes and windstorms are frequent in Florida, yet claims related to these natural disasters are fraught with challenges. We'll explore the intricacies of hurricane deductibles, which differ significantly from standard deductibles, and the importance of timely filing and meticulous documentation post-disaster.

- Hurricane Deductibles: Unlike standard deductibles, hurricane deductibles in Florida are based on a percentage of the home's value.

- Documentation and Timely Filing: After a hurricane or windstorm, prompt and detailed documentation of damages is essential for a successful claim.

IV. Mold Damage Claims

Mold damage claims are a contentious issue, often leading to denials. This part will discuss the complexities involved in proving mold damage and its origins, along with practical tips for homeowners to document and report mold issues effectively.

- Proving Mold Damage: Demonstrating the source and extent of mold damage can be challenging. It requires clear documentation and sometimes professional assessments.

- Effective Reporting: Homeowners should report mold issues as soon as they are discovered and provide thorough documentation to support their claims.

V. Wear and Tear or Lack of Maintenance Claims

Claims related to general wear and tear or lack of maintenance are commonly denied. This section emphasizes the homeowner’s responsibility for regular upkeep and offers advice on distinguishing between sudden accidental damage and gradual deterioration.

- Homeowner Responsibility:

Regular maintenance is key. Insurance typically does not cover damages that result from neglect or lack of maintenance.

- Differentiating Damages: Understanding the difference between sudden accidental damage and gradual wear and tear is crucial for filing a successful claim.

VI. Roof Damage Claims

Roof damage claims are frequently denied due to issues like the age and condition of the roof. We'll discuss the importance of regular roof inspections and maintenance, and how to document these for insurance purposes.

- Roof Age and Condition:

The age and overall condition of your roof play a significant role in claim approval.

- Regular Inspections: Documenting regular roof inspections and maintenance can be vital in supporting a roof damage claim.

VII. Understanding Policy Terms and Conditions

One of the keys to avoiding claim denials is a thorough understanding of your insurance policy's terms, conditions, and exclusions. This section provides tips on how to review and clarify coverage with insurance providers.

- Policy Review:

Regularly review your policy to understand its specific terms and conditions.

- Clarification with Providers: Don't hesitate to ask your insurance provider for clarifications on any aspect of your coverage.

VIII. How to Avoid Claim Denials

Avoiding claim denials involves best practices in filing claims, thorough documentation, prompt reporting, and sometimes seeking professional assessments or legal advice. This part will guide readers through these best practices.

- Best Practices: Learn the best practices for filing claims, including thorough documentation and prompt reporting.

- Seeking Assistance: In complex situations, don't shy away from seeking professional assessments or legal advice.

IX. Conclusion

We'll recap the key points discussed and stress the importance of proactive management and regular review of insurance policies to ensure they meet current needs.

X. Next Steps

For further assistance in understanding insurance policies or dealing with claim denials, contact our agency for policy reviews or questions regarding potential claims.

Get a homeowners quote online today and start protecting your home and future.