Navigating the Florida Insurance Market Crisis: Understanding Costs, Weather Challenges, and Legal Complexities

I. Introduction

In Florida, a state beset by unique environmental challenges, insurance is not just a commodity but a necessity. This article aims to shed light on the common grievances Floridians face with their insurance experiences, amidst a backdrop of natural disasters and a complex legal environment.

II. High Cost of Premiums

The soaring costs

of insurance premiums in Florida, especially for homeowners and auto insurance, are a major source of concern. Factors contributing to these high costs include:

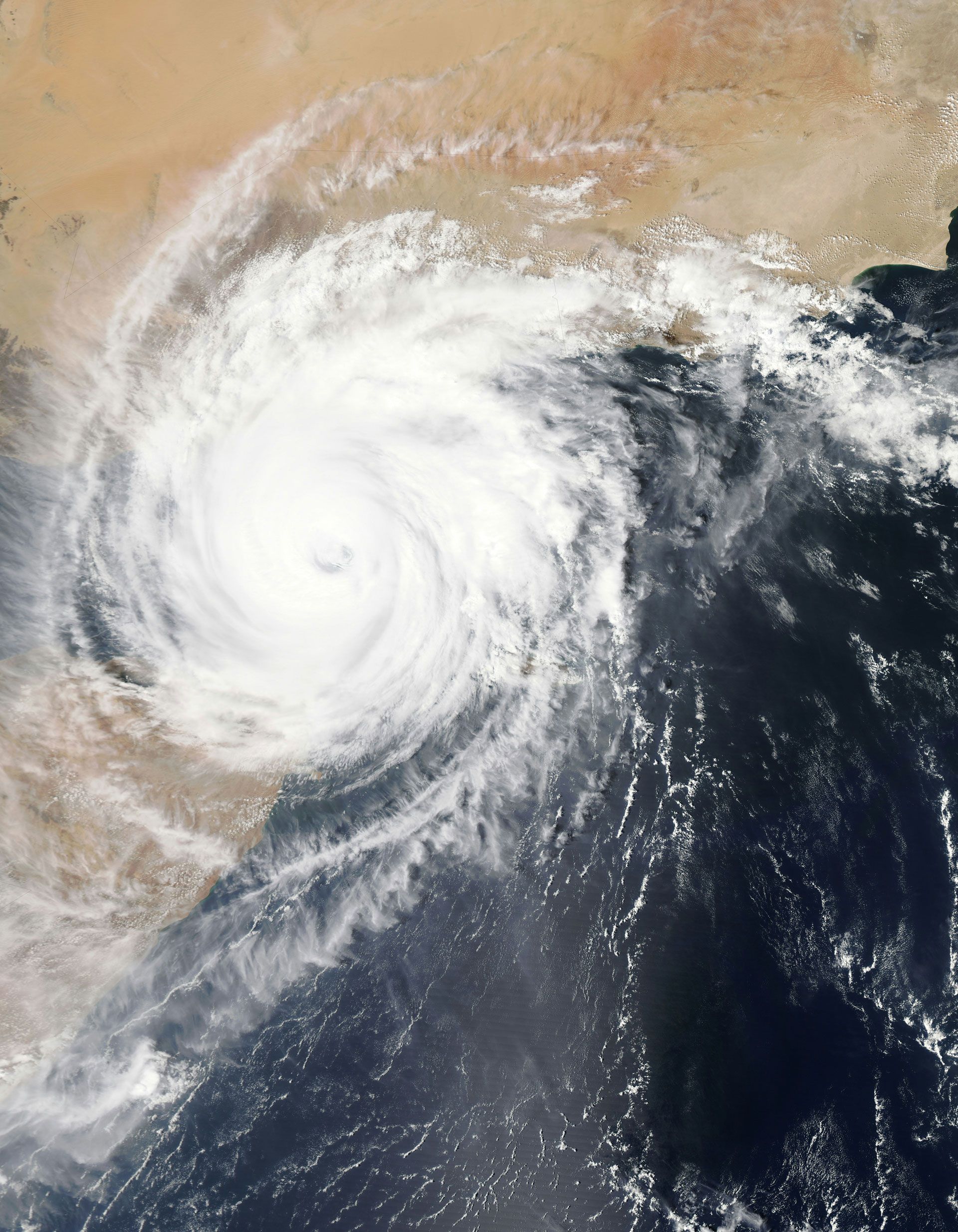

- Risk of Natural Disasters: Florida's susceptibility to hurricanes and floods significantly drives up insurance costs.

- Insurance Fraud: Rampant insurance fraud in the state adds to the financial burden on insurance companies, which in turn is passed on to consumers.

III. Complexity of Policies

Navigating the labyrinth of insurance policies is a daunting task for many Floridians. Key issues include:

- Jargon and Complexity: Policies are often filled with technical terms, making it hard to understand what is covered.

- Hurricane and Flood Coverage: Special attention is needed to understand policies related to these specific disasters.

IV. Limited Coverage Options

In high-risk areas, finding comprehensive coverage that meets all individual needs is challenging. This section explores:

- Limited Availability: Many insurers are reluctant to offer comprehensive policies in high-risk zones.

- Need for Multiple Policies: Often, residents need to purchase separate policies for different types of coverage.

V. Claims Processing Delays

Delays in claims processing, especially following widespread events like hurricanes, are a common frustration. The impact includes:

- Delayed Recovery: Slow processing can hinder recovery efforts for individuals and businesses.

- Financial Strain: Delays can exacerbate financial difficulties for those awaiting insurance payouts.

VI. Unpredictable Rate Increases

Unpredictable and significant rate increases are a source of frustration. This section will delve into:

- Lack of Transparency: Often, there is little to no explanation provided for these rate hikes.

- Economic Impact: These increases can have a substantial impact on household and business finances.

VII. Poor Customer Service

Issues with customer service in the insurance industry include:

- Slow Response: Lack of responsiveness during critical times adds to policyholders' stress.

- Inadequate Support: Many find the support during claims to be insufficient.

VIII. Restrictions and Exclusions

Various restrictions and exclusions in insurance policies often lead to denied claims. Common issues include:

- Water Damage Exclusions: Certain types of water damage are frequently not covered.

- Understanding Policy Limits: Knowing what is and isn’t covered is crucial to avoid surprises during claims.

IX. Conclusion

This article has highlighted the key frustrations for Floridians regarding insurance. Understanding and effectively navigating these policies is essential for adequate protection.

X. Next Steps

We encourage readers to educate themselves about their insurance policies and to consult with insurance experts. Attending local seminars and workshops can also provide valuable insights into effectively managing insurance in Florida's unique market.

Get a homeowners quote online today and start protecting your home and future.