The Homeowners Insurance Crisis in Florida: Navigating the Storm

I. Introduction

In Florida, homeowners are grappling with a growing crisis in the insurance sector. This article explores the "homeowners insurance crisis" in Florida, examining the challenges faced by insurance companies and homeowners alike. We aim to shed light on the roots of this crisis and its impact on the residents of the Sunshine State.

II. Understanding the Homeowners Insurance Crisis in Florida

The crisis in Florida's homeowners insurance sector is complex and multifaceted. It has evolved over time, leading to the current precarious situation. This section will define the crisis and provide a historical overview.

III. Factors Contributing to the Crisis

Several key factors have contributed to the crisis:

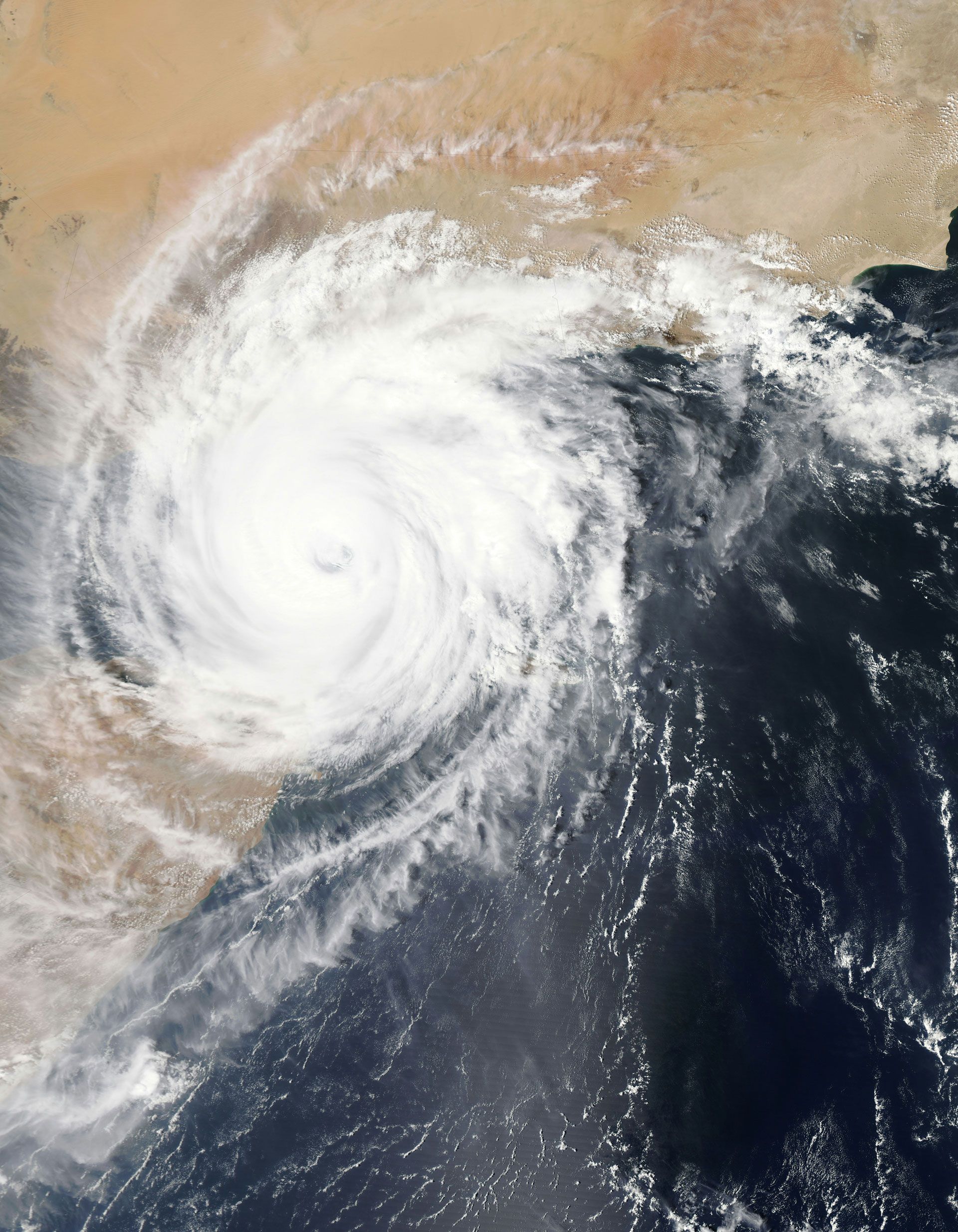

- Weather-Related Challenges: Florida's high risk of hurricanes and floods significantly impacts insurance costs and coverage availability.

- Legal and Litigation Issues: The state's legal environment, including frequent litigation, has put additional pressure on insurance companies.

- Economic Factors: Rising property values and repair costs further strain the insurance market.

IV. The Impact on Insurance Companies

Insurance companies in Florida are deeply affected by the crisis:

- Many have withdrawn from the market due to unsustainable losses.

- Financial strains and high-risk assessments are commonplace.

V. Consequences for Florida Homeowners

Homeowners face direct repercussions:

- Rising Premiums: Insurance costs have skyrocketed, placing a heavy burden on many homeowners.

- Coverage Challenges: Obtaining comprehensive coverage is increasingly difficult.

- Case Studies: Real-life examples highlight the struggles faced by homeowners.

VI. Legislative and Regulatory Responses

The Florida government and regulatory bodies have taken steps to address the crisis:

- Recent legislative changes aim to stabilize the market.

- The effectiveness of these measures is a subject of ongoing debate.

VII. Strategies for Homeowners

Practical advice for homeowners includes:

- Tips for securing reliable insurance coverage.

- Strategies for managing insurance costs.

- Exploring alternative insurance options in Florida.

VIII. The Future Outlook

Experts predict a challenging road ahead, but there are potential solutions and strategies for market stabilization.

IX. Conclusion

This crisis requires awareness and proactive measures from homeowners. Understanding the complexities of the insurance market in Florida is crucial.

X. Next Steps

Stay informed and actively manage your homeowners insurance needs. Seek out resources for further information and assistance on how to protect your peace of mind.

Get a personalized quote online today and start protecting your home and future.